Introduction

Embark on a journey into sustained success within the complex realm of Revenue Cycle Management (RCM). This case study unveils the strategies behind consistently maintaining Accounts Receivable (AR) below 5% beyond the critical 90-day mark. Discover actionable insights tailored for professionals navigating the intricacies of RCM in the U.S. healthcare landscape. Join us as we explore the keys to sustaining a lean AR balance, ensuring enduring financial excellence in healthcare operations

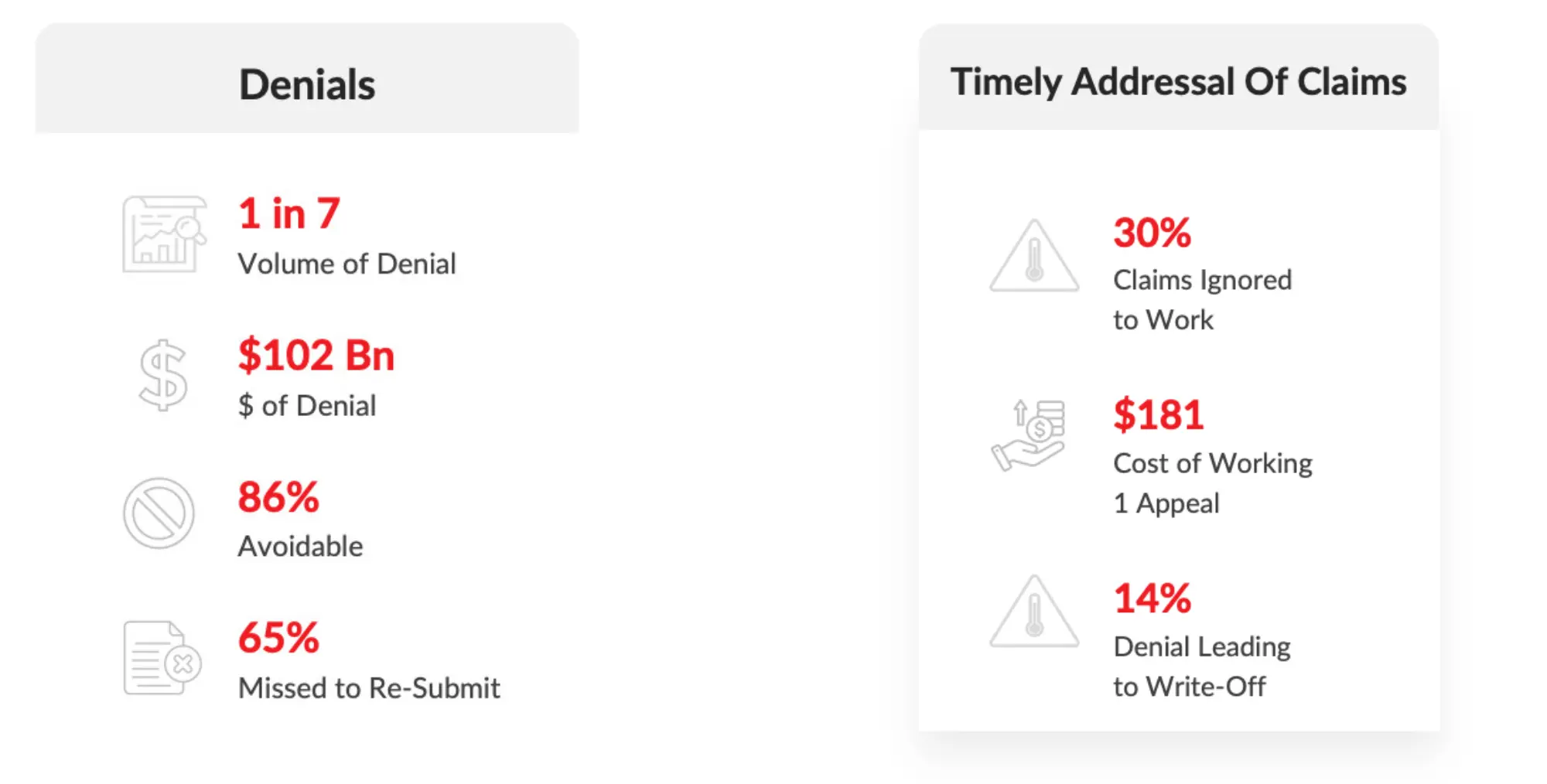

Industry Challenges - Insights

Problem statement

- Inefficient Eligibility & Benefits Verification.

- Higher Medical Necessity denials.

1. Denials Untouched, high denials are:

2. In-Appropriate Payment Posting.

3. Claims not followed up on time.

4. Appeals have not worked and have not followed up.

5. Resolution of claims <90 days was lagging.

Pain Point of the Customer:

Our client, based out of Philadelphia was facing increased denials due to preventable causes which lead to an increase in Aging AR getting piled up (>90+ Days AR). Pharmacy claims cover the medicine subsidy and dispensing costs associated with supplying prescribed pharmaceutical items to patients.

Challenges:

- Team of revenue cycle experts in pharmacy billing analyzed the trends in denials and identified the following issues that led to many rejections and denials, causing delays in cash flow

- Claim denied for Medical records.

- For example: If the claim was denied for medical records, only limited documentation was sent. We figured out the exact MR documents which need to sent for having the claims processed and fixed it

- Payment was captured in unapplied

- Claim paid which is greater than 30 days

- Out team identified the missing EOBs to post payment which make the claim move out aging

- If not coded to their highest specificity, diagnosis codes cause denials and reduced reimbursements.

- Filing of the guidance codes individually provoked more rejections and denials

- There was a delay in the billing process due to the increased number of clarifications, which led to charge lag and an increase in AR days

- Missing more specific diagnosis codes can cause errors and increase denials and rejections

Solution:

- ERA Setup was initiated for the missed payers which eradicated the missing EOBs.

- Analyzing physician-wise trends to make sure that we are sharing the details with the provider on the claims which are pending for additional details

- We educated the providers in the group on the commonly used guidance and explained to them the importance of documenting the guidance details for sooner filing and reimbursement

- Insights regarding the issues in medical records were shared with the providers as and when required to avoid recurrence and improve the clean claim ratio

- Initiated appeals on timely manner

Result:

- We were able to streamline the AR days

- AR Days was bought down to 60 days when it was compared with 147 days when we onboarded the client

- Unapplied $7M was posted to the decrease in AR which played a vital role in cleaning the AR

- Non-Collectible accounts were adjusted

- Collected over $27.5 Million in AR Recovery > 90 days.