Navigating the Future: A Step-by-Step Journey Through the Medical Claim Lifecycle in 2025

Step 1: The Patient's Initial Visit

The lifecycle of a medical claim begins when a patient seeks care from a healthcare provider. This could be for a routine check-up, an emergency visit, or a specialty consultation. At this stage, several key details are gathered:

- Patient's Information: The patient provides necessary demographic and insurance details.

- Insurance Verification: The provider's office verifies the patient's insurance coverage to ensure they are eligible for the service.

- Service Code Entry: The healthcare provider will code the service being provided, including diagnosis codes (ICD-10) and procedure codes (CPT), to be used during billing.

Step 2: Healthcare Provider Submits the Claim

Once the patient's service has been provided, the healthcare provider or their billing department submits the claim to the insurance company. This submission can be done electronically or on paper, though in 2025, the majority of claims are processed electronically. The submitted claim includes:

- Patient's Information: Basic details and the patient's insurance.

- Procedure Codes (CPT/HCPCS): Codes that describe the services provided during the visit or procedure.

- Diagnosis Codes (ICD-10): Codes indicating the medical condition that was treated.

- Charges: The amount the provider is requesting for reimbursement.

Step 3: Claim Review by the Insurance Company

After the healthcare provider submits the claim, it is received by the insurance company for processing. The insurance company will review the claim to ensure that all the information is correct and that the services provided are covered under the patient's insurance policy. At this stage, the insurance company may do the following:

- Eligibility Verification: The insurer confirms the patient's insurance coverage for the service rendered.

- Medical Necessity Review: The insurer assesses whether the services were medically necessary based on the diagnosis codes and procedure codes.

- Pre-authorization Check: If required, the insurer checks if any pre-authorizations or approvals were obtained before the services were rendered.

- Claim Adjudication: The claim is processed to determine how much of the billed amount will be covered under the patient's policy, and what amount, if any, will be the patient's responsibility (copays, coinsurance, deductibles).

Step 4: Claim Approval or Denial

Once the insurance company processes the claim, the provider and the patient will receive an Explanation of Benefits (EOB) or an Electronic Remittance Advice (ERA). These documents explain the outcome of the claim review:

- Approved Claims: If the claim is approved, the insurer will pay the healthcare provider a portion of the claim, as per the terms of the patient's policy.

- Denied Claims: If the claim is denied, the insurer will provide a reason for the denial, which could range from incorrect coding to lack of medical necessity or failure to obtain prior authorization.

Step 5: Payment Processing

After the claim has been approved, the insurance company processes payment to the healthcare provider. In 2025, payment is often completed electronically through Electronic Funds Transfer (EFT). The provider receives payment based on the insurance policy's terms. At this point, the patient is responsible for any remaining balance that the insurance did not cover, such as:

- Deductibles: The amount the patient must pay out-of-pocket before insurance coverage kicks in.

- Copayments: A fixed amount the patient pays for certain services.

- Coinsurance: A percentage of the costs the patient is responsible for after the deductible has been met.

Step 6: Patient Payment

Once the healthcare provider receives the payment from the insurer and the patient's remaining balance is determined, the patient will be billed for their portion of the charges. This could be:

- A single bill for the remaining balance, which includes deductibles, copays, and coinsurance.

- Payment plans may be offered by the provider for patients who cannot pay the full amount upfront.

Step 7: Claim Finalization and Closure

Once the payment has been received, either from the insurance company or the patient, the medical claim process is considered closed. At this point, the healthcare provider’s billing department updates their records, marking the claim as completed. If there are any disputes or outstanding issues, such as delayed payments or discrepancies, the provider may continue to follow up with the insurer or patient until everything is resolved.

Conclusion: Navigating the Medical Claim Lifecycle in 2025

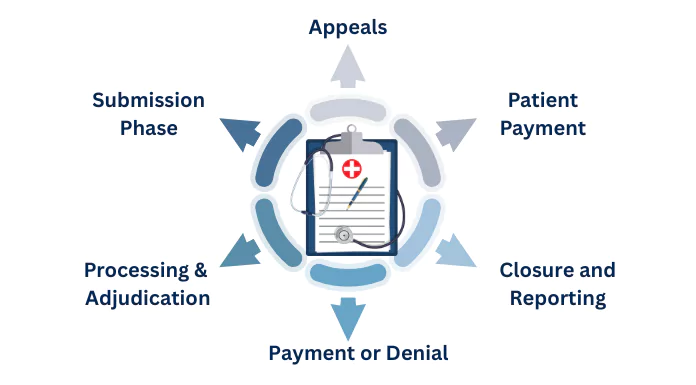

The lifecycle of a medical claim in 2025 is increasingly complex, but with a solid understanding of the process, patients and healthcare providers can manage claims more effectively. By following this visual walkthrough, you can better understand what happens to your medical claim from start to finish—whether you're a patient trying to comprehend the billing process or a healthcare provider striving to streamline your revenue cycle management.

Through improved technology, better communication, and a clearer understanding of the lifecycle, the goal is to reduce confusion and improve the experience for everyone involved. As we move further into 2025, expect more advancements that will simplify and automate the process, creating a more efficient healthcare billing environment.

To stay ahead in the evolving landscape of medical claims, contact iMagnum Healthcare Solutions today and discover how their cutting-edge platform can streamline your billing process, reduce errors, and enhance your revenue cycle management.